|

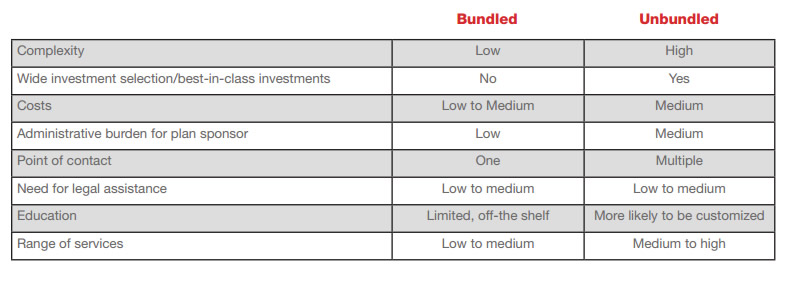

Guest Article Unbundled Providers Make Sense for Small 401k PlansBy Buddy Horner, QKA, Director, Retirement Plan Consulting with Bronfman E.L. Rothschild Workplace retirement plan sponsors have a number of responsibilities to fulfill when selecting service providers. Service providers help perform three important functions of 401k plans: recordkeeping (processing transactions such as contributions, loans, distributions, website access, reporting); third party administration (TPA) (compliance, plan documents, non-discrimination testing); and investment advisory (management of investments). One decision a plan sponsor must make is whether to select a bundled or unbundled provider of these three services. With a bundled model, a plan sponsor selects one provider for all the recordkeeping, administration and possibly investment services. Bundled service providers serve as a one-stop shop generally offering one standard plan with less flexibility. In an unbundled plan, the plan sponsor selects services from a combination of independent service providers. This enables the plan to pick best-in-class service providers including investment options. Many small companies choose a bundled plan because they do not have the staff to select and manage multiple service providers. However, some plans gravitate towards unbundled services as they grow in order to seek more control and look to add a wider variety of investment options. Deciding whether to select bundled or unbundled services rests on a number of factors. What plans may gain in terms of flexibility they may trade off in terms of complexity, and sometimes in cost. The following table compares a number of these factors as they generally relate to bundled and unbundled plans:

While it may be contrary to common belief, bundled providers may also work better for larger companies with staff members entirely dedicated to employee benefits. In these instances, internal staff is more likely to be aware of all the tasks that need to be handled so the recordkeeper then doesn't need to perform every task. In our experience, plan sponsors are more likely to get what they want with unbundled plans which offer higher levels of service, regardless of their size. Here are a few reasons to consider unbundled providers:

In the end, most smaller plans are willing to pay for the added service and additional confidence that come with working with unbundled partners. Plans can rely on the service provider's experience to provide the knowledge and support they may lack on staff. Providers may be willing to invest in the relationship over time leading to quality outcomes in the end. Bronfman E.L. Rothschild is a registered investment adviser. Securities, when offered, are offered through an affiliate, Bronfman E.L. Rothschild Capital, LLC (dba BELR Capital, LLC), Member FINRA/SIPC. © 2017 Bronfman E.L. Rothschild, LP ### 401khelpcenter.com is not affiliated with the author of this article nor responsible for its content. The opinions expressed here are those of the author and do not necessarily reflect the positions of 401khelpcenter.com. | ||||

|

About

| Glossary

| Privacy Policy

| Terms of Use

| Contact Us

|