|

Guest Article Best Practices in Financial Education for Gen X: A Generation Caught in the MiddleBy Liz Davidson, founder and CEO of Financial Finesse.

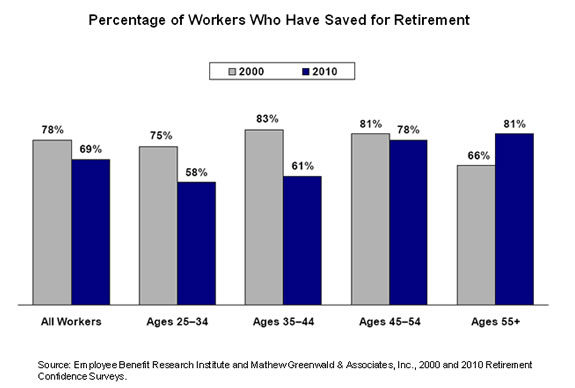

Many Baby Boomers have pensions and even though they may be currently frozen or replaced with a cash balance pension plan, at least they will have some retirement income from a company pension. Contrast that with Gen X employees who either never had one or had their plan frozen not long after they entered the workforce. A safety net was installed with the Pension Protection Act of 2006 allowing automatic enrollment into 401k plans but this was not a significant benefit for Gen X since many employers enacted this feature for new employees only. Gen Y (or Millennials) would be the beneficiaries of this legislation since they were starting their first jobs at the time it was enacted. The Gen X employee missed both the defined benefit pension and the safety net of the auto enrollment thus making their retirement planning more challenging. With these additional challenges, the Gen X employee actually needs to be the generation ahead but they are caught in the middle, instead doing worse in vital financial areas. The Gen X employee shows poor financial literacy scores compared to Baby Boomers and Gen Y in having a handle on their cash flow, paying their bills on time, and saving for retirement.

Gen X has a different world view - one where there are no guarantees. The economic situation they came of age in gave them a more skeptical outlook than other generations. Many of them are also hitting a life stage where they have competing priorities with young children at home while at the same time having to fund their retirement and possibly take care of their own parents. Overall, Generation X employees have formidable challenges in planning for retirement, but financial education that is tailored to this generation can help. Here are some best practices in financial education for Generation X employees: Generation X employees are skeptical - Provide them with conflict-free communication and hands-on tools.

Generation X employees are behind the curve - Provide easy to implement solutions to help them succeed.

Generation X employees have competing priorities - Provide holistic planning that integrates all the resources available to them.

Retirement Preparedness for the Gen X employee is not an impossible goal even with the list of challenges they face. Employers who take into account the unique world view of Gen X will help the Gen X employees who are caught in the middle between the Baby Boomers and Gen Y. Not unlike the middle child in a family, the Gen X employee needs focus and attention that might not be immediately noticeable but is vital. This research has been compiled by Financial Finesse's Think Tank of CERTIFIED FINANCIAL PLANNER™ professionals, Trisha Brambley, President, Retirement PLAYBOOK, Inc. a leading expert in this area, and dozens of studies on Generation X. For additional research and best practices on Gen X and Financial Education, email AskFF@financialfinesse.com. Trisha Brambley can be reached at trishbrambley@gmail.com. About Financial Finesse Financial Finesse was founded with a single mission: Provide people with the information they need to become financially independent and secure. Today, we are the leading provider of unbiased financial education for large companies and municipalities. Our financial education services are fully integrated programs designed to address the strategic goals of the organizations we service and are delivered by on-staff Certified Financial Planner™ professionals as an employee benefit. If you are interested in learning more about workplace financial education programs, contact one of our education consultants at AskFF@financialfinesse.com. The Ask Financial Finesse Q&A service is designed to provide general information on trends and developments in workplace financial education programs and participant education strategies. Due to the complex nature of financial benefits and/or workplace financial issues, the information contained in this document is not to be construed as advice. ### 401khelpcenter.com is not affiliated with the author of this article nor responsible for its content. The opinions expressed here are those of the author and do not necessarily reflect the positions of 401khelpcenter.com. |

|

About

| Glossary

| Privacy Policy

| Terms of Use

| Contact Us

|