|

401k Plan Loans - An Overview(Cont...) The Cons

When You Probably Shouldn't Borrow From Your Plan It is probably not wise to take out a 401k plan loan when:

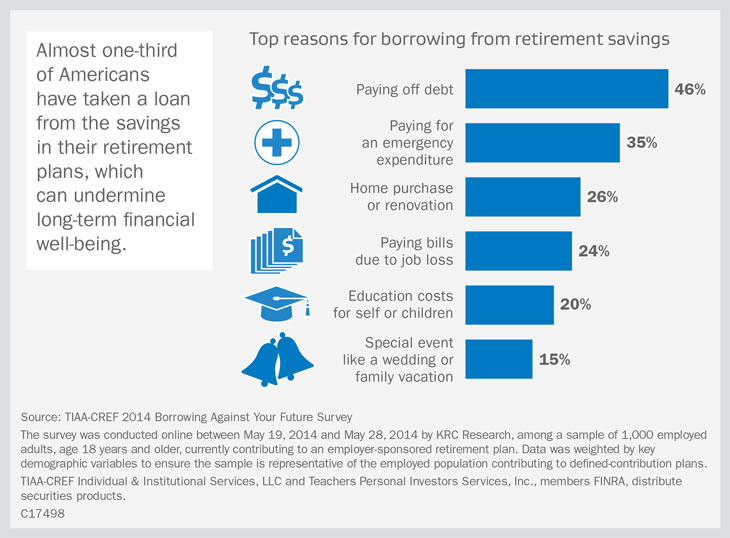

Commonly Asked Questions What are some of the most common reasons people take out a plan loan?

If I want to borrow for a down payment on the purchase of my primary residence, do I have to pay the loan back in five years like a normal 401k loan? No, most plans allow longer pay back terms when the loan is going to be used to purchase a primary residence. Ten to fifteen years is common. How long do I have to pay off my loan if I quit my job? Typically, if you quit working or change employers, it is not uncommon for plans to require full repayment of a loan. Prior to the passage of the Tax Cuts and Jobs Act of 2017, participants who had left employment with an outstanding loan were expected to pay off the balance within 60 days of separation or face a 10% withdrawal penalty and have the distribution be considered taxable income. The Tax Cuts and Jobs Act of 2017 provides a greater repayment window, as individuals now have until the filing deadline of their individual tax return to avoid the tax consequences of a deemed distribution of an outstanding plan loan. Will a 401k loan appear on my credit report? Loans from your 401k are not reported to the credit-reporting agencies, but if you are applying for a mortgage, lenders will ask you if you have such loans and they will count the loan as debt. If I default on my loan, will the default be reported to the credit-reporting agencies? If you default on a 401k loan, the default will not be reported to the credit-reporting agencies and it will not negatively impact your credit rating. If I can't afford to keep making the payments on my loan, can I stop them? Once the loan has been made, your payments will be deducted from your pay each month and you generally can't stop this process. If I default on my loan, how will I know the amount I must report as income on my federal tax return? You will receive a 1099 from the plan which will show you the exact amount to report. This amount will also be reported to the IRS. I still have a 401k account at a former employer. Can I get a loan from this old 401k? Plans are not require to let former employee take plan loans and few allow them to do so. Where can I learn more about how my specific plan handles 401k loans? Talk to your plan administrator or ask them for a copy of your plans Summary Plan Description (also known as an SPD). The SPD will spell out exactly how and why you can obtain a loan from your 401k. Additional Reading The Pitfalls of Taking a Loan From Your Retirement Plan - Abstract: "I might need my money." This is a remark that is frequently voiced by retirement plan participants. Plan loans are one way to ensure access, but, as the author notes, there are several pitfalls related to these 401k plan loans that participants should be aware of. Plan Loans -- Whose Money Is It Anyway, and Why Should You Care? - Abstract: Plan loans are popular with both employers and employees, but loans bring with them a number of additional administrative and legal requirements for which the plan sponsor is generally responsible. Improper plan loans are among the most common defined contribution plan compliance errors. This 20-page paper from the Journal of Pension Planning & Compliance the complexity of properly administering plan loans. How to Avoid Borrowing From Your Retirement Plan - Abstract: Have you ever borrowed from your retirement plan? When you need cash in a hurry, it can be tempting. However, there are a couple of reasons why this may not be the best idea. < PREVIOUS Page 2 of 2 The information provided here is intended to help you understand the general issue and does not constitute any tax, investment or legal advice. Consult your financial, tax or legal advisor regarding your own unique situation and your company's benefits representative for rules specific to your plan. | ||||

|

About | Glossary | Privacy Policy | Terms of Use | Contact Us

|